2023 market forecast: additions to the release schedule increase annual box office prediction to $9 billion

February 28, 2023

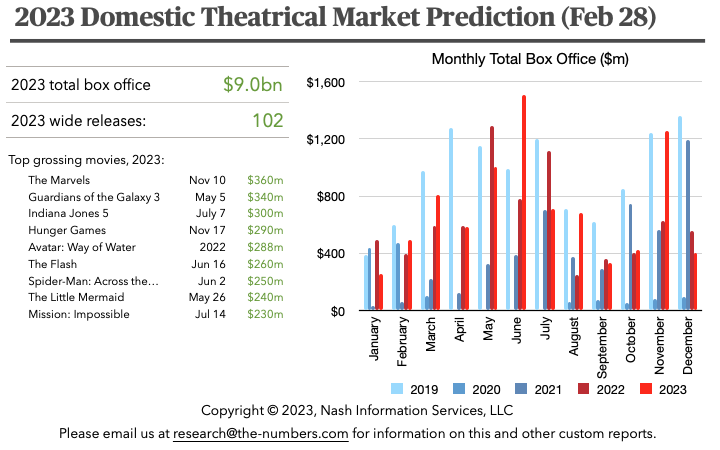

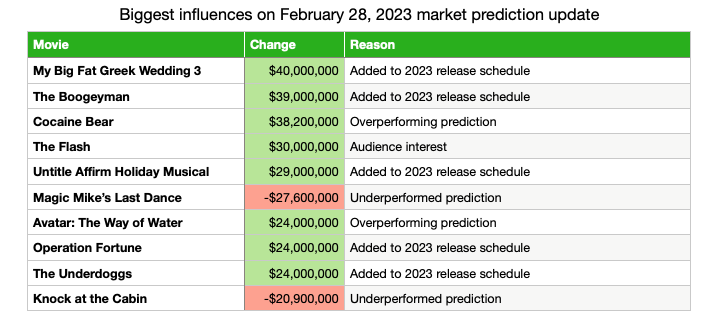

Some additions to the release schedule over the past few weeks have helped boost our model’s prediction for the overall domestic box office for 2023 up by a couple of hundred million dollars since our last update, to $9 billion. We’re now expecting 102 wide releases, up six from the announced list at the end of January, and up four from what we had assumed in our model. While the added releases aren’t in the blockbuster category—the model’s highest prediction for a new addition is a modest $40 million—they all have the potential to become mid-level hits, and they are spread throughout the year, which is exactly what theater owners need.

Subscribe to our Bankability and Box Office report for full details, or read on for an overview of what our model thinks of the next 12 months in movie theaters…

Here’s an overview of how everything looks through the end of 2023. The bars in the chart estimate the total box office for all films released in a particular month.

The biggest shift in monthly expectations comes from The Marvels’ move from July 28 to November 10. The model thinks that will help its overall performance due to a slightly stronger release date, while it obviously also gives November’s total a boost at the expense of July.

That means that the end-of-Summer slump continues to look tough for the industry. The addition of My Big Fat Wedding 3 on September 8 does at least boost things a bit. Putting out a real crowd pleaser at the end of August or early September would pretty much guarantee two months without much competition. Perhaps that movie can be it.

MBFGW 3 is actually the movie that gives our overall market prediction its biggest boost this month:

Like M3GAN in January, Cocaine Bear is nicely exceeding expectations. The model wasn’t all that keen on Ant-Man and the Wasp: Quantumania to begin with, so its performance so far, while widely viewed as a disappointment, is actually $5 million better than our prediction last month.

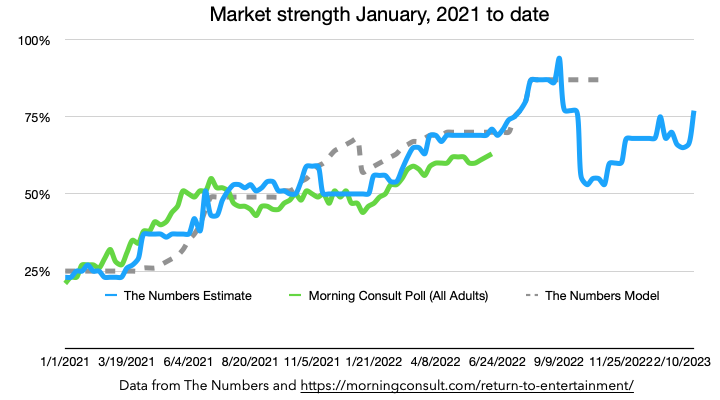

The performance of Cocaine Bear and Jesus Revolution last weekend gave a welcome boost to our market strength measurement. Like last month, I think it is slight under-estimating the theatrical audience right now, and I’m keeping our expectation for market strength at 90% of pre-pandemic levels through the rest of the year.

The performance of these two films, plus 80 for Brady, which opened at the beginning of February, suggest that the market is trending back towards normal. It’s worth noting that the top 9 movies listed at the top of this article—the ones expected to make $230 million or more at the domestic box office—account for just over $2.5 billion of the overall market prediction. The other $6.5 billion will come from smaller films, many of them chipping in $30 million, $40 million, or $50 million. The major studios still aren’t releasing enough of them, particularly between August and October, which opens up some opportunities for independent distributors. And, I dare say, it’s also an opportunity for a streaming service or two to earn some extra dollars by putting their films in theaters. I think we’ll see more of that before the year is out—something that’s not factored into the model at this point, by the way.

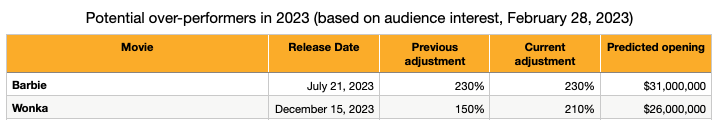

The top two potential breakout hits this month are familiar names at this point. Barbie and Wonka both fall into the category of films that aren’t obvious tentpoles (at least as far as our model is concerned), but could by excellent earners. They’ve both been garnering excellent audience interest given how long it is until their release.

For full details of which movies our audience tracking suggests will have breakout performances, a list of predictions for all movies coming out in wide release between now and the end of 2023, month-by-month details, plus the latest updates to our Bankability values for acting and creative talent in the industry, purchase or subscribe to our Bankability and Box Office report.

Our market prediction is based on the same model as the weekend predictions that we’ve been running since theaters started reopening towards the end of 2020. We are now running the prediction model for every announced wide release on the release schedule and estimating the size of the market as a whole by assuming a relatively small amount of additional revenue from limited releases. The prediction for each movie is based on six factors:

The performance of similar films in recent years, and cast and crew Bankability. So far as possible, the model uses films in the same genre released by the same distributor as points of comparison. The predicted performance of franchise films is based on previous releases in the franchise. Cast and crew Bankability is weighted more heavily for non-franchise than for franchise films.

The current state of the theatrical market. We update our model after each weekend with a wide release to estimate what proportion of formerly-regular moviegoers are currently going to theaters.

Adjustments for specific genres. The pandemic has affected different segments of the audience in different ways. We are currently adjusting movies with romantic content down by 20%, but not adjusting any other genres.

Adjustments for day-and-date streaming releases. This was taken into account when films were being simultaneously released on HBO Max and in theaters on the same day. Since that’s no longer happening, and we haven’t seen a measurable impact from films being released simultaneously on Peacock and Paramount+, no adjustment is currently being made. We are continuing to monitor this aspect of the industry.

Potential breakout hits. Films that have the potential to break out beyond what the model otherwise predicts are identified and their predictions increased accordingly. These films are currently selected based on our measurement of audience interest.

The expected recovery of the theatrical market as the pandemic is brought under control. The model assumes that the market will settle back to 90% of its pre-pandemic size at the end of the recovery. Growth was slow at first, accelerated as more people become confident in going to theaters, and then will slow down as more cautious moviegoers take time to return to attending. This is the classic ''S-shaped'' curve seen in economics textbooks (and in many cases in the real world). (For more on this see my previous article, How quickly can the box office recover?) Those parameters are likely to be adjusted as the market situation evolves.

- Current release schedule

Bruce Nash, bruce.nash@the-numbers.com

Methodology

- Recent release schedule changes

- Subscribe to the Bankability Index for full details on our market predictions

Filed under: Ant-Man