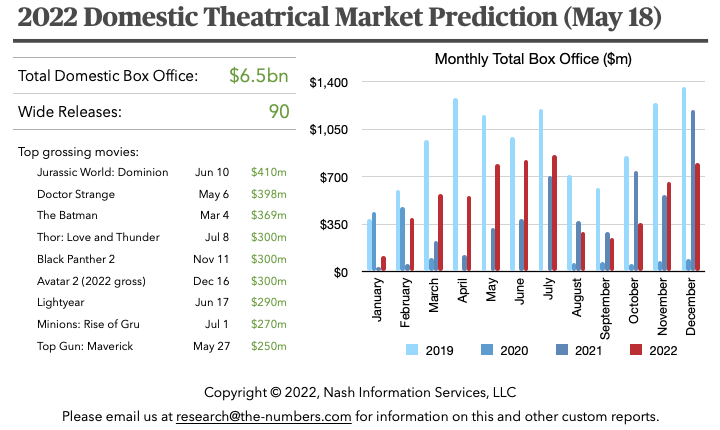

2022 market prediction: multiverse movie movements reduce annual prediction to $6.5 billion

May 19, 2022

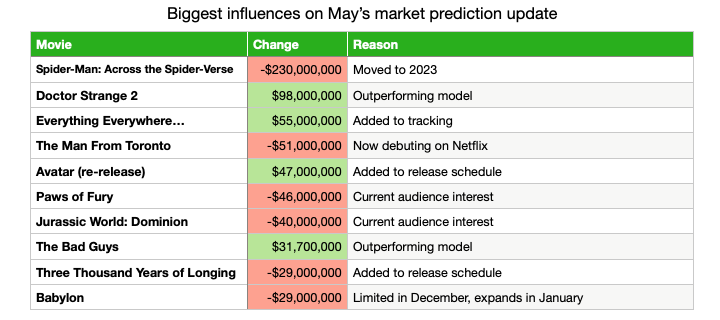

This month’s market prediction is a tale of three multiverses. In the positive multiverses, Doctor Strange in the Multiverse of Madness handily outperformed our model’s prediction at the beginning of May; and Everything Everywhere All At Once has clocked up nearly $50 million since its limited debut at the end of March, and is showing remarkable staying power in its eighth week in release. These pieces of good news are offset by Spider-Man: Across the Spider-Verse being pushed back to June 2, 2023. That puts a big hole in the market in October that looks unlikely to be filled at this point, and brings the overall prediction down by $200 million from last month.

Here’s how our prediction for 2022 looked as of May 18…

And here’s what’s caused the biggest movements in our prediction over the last month:

The negative impact of that move for Spider-Man speaks for itself. Instead of having a potential juggernaut to kick off the Holiday season (and frankly, the model’s $230-million prediction was most likely on the low side), October is now looking thin. Perhaps the newly-announced re-release of Avatar at the end of September will help boost the market (the model thinks it’ll do around $47 million), or Halloween Ends and Black Adam will benefit from the lack of competition. But right now, it looks a decent bet that we won’t see a $100-million opener in August, September, or October, and Black Panther: Wakanda Forever will need to do gangbusters business when it arrives on November 11.

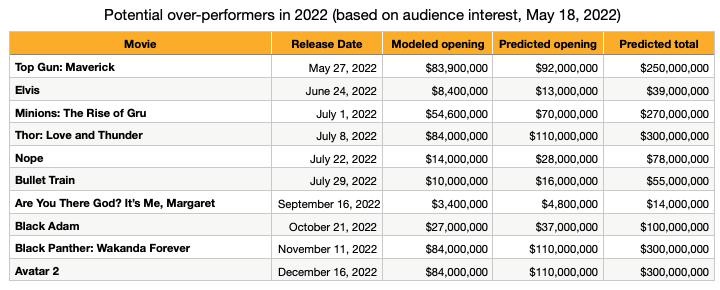

Black Adam is at least tracking ahead of our model, based on audience interest, along with nine other films coming out between now and the end of the year.

Purchase our Bankability Index report for a full list of predictions for all movies coming out between now and the end of the year.

Top Gun: Maverick is looking strong ahead of its opening in just over a week, and it joins the “possible breakouts” list for the first time. Elvis and Nope are going from strength to strength, with the audience adjustment boosting the former by $5 million from last month and the latter by $22 million. Bullet Train also moves up a bit this month, from a predicted total of $52 million to $55 million.

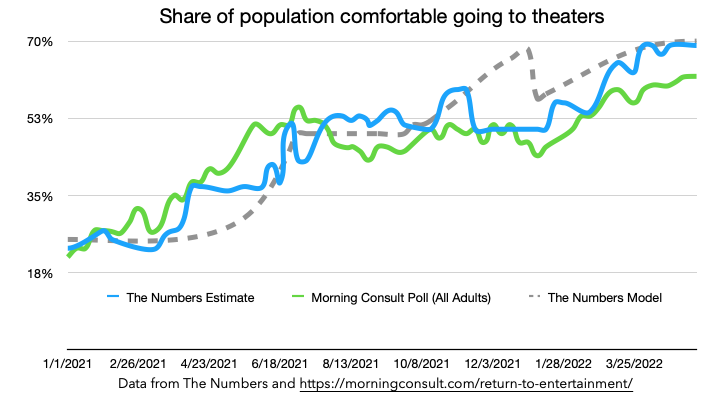

What isn’t changing this month is our baseline market size assumption, which has now flattened out at 70% of the pre-pandemic level. Some movies are clearly breaking out above that level, but just as many are falling short. Our measured market size adjustment stands at 69% right now, and has been hovering at that level for about a month.

Morning Consult’s current estimate of the share of the population comfortable going to movie theaters stands at 62%, which is a high for their survey, but now seems to be tailing off a little below our number. (Click on the chart to see Morning Consult’s full analysis.)

I said last month that the 70% ceiling in our model was about to be put to the test, and it’s fair to say it held firm. Perhaps we’ll see a bit more of a positive trend as the Summer season picks up, but for now I’m sticking with that as the long-term projected market size.

Our market prediction is based on the same model as the weekend predictions that we’ve been running since theaters started reopening towards the end of 2020. We are now running the prediction model for every announced wide release on the release schedule and estimating the size of the market as a whole by assuming a relatively small amount of additional revenue from limited releases. The prediction for each movie is based on six factors:

The performance of similar films in recent years, and cast and crew Bankability. So far as possible, the model uses films in the same genre released by the same distributor as points of comparison. The predicted performance of franchise films is based on previous releases in the franchise. Cast and crew Bankability is weighted more heavily for non-franchise than for franchise films.

The current state of the theatrical market. We update our model after each weekend with a wide release to estimate what proportion of formerly-regular moviegoers are currently going to theaters. As of today, that figure is 69%. We also monitor Morning Consult’s weekly survey of moviegoers, and may make adjustments to our analysis if our number varies significantly from theirs.

Adjustments for specific genres. The pandemic has affected different segments of the audience in different ways. We are currently using four categories of movie in our model: “date night” films (which are doing worse than the general market), action movies (which are doing slightly better), family films, and “everything else” (which includes drama, comedy, and horror movies, among others). Family films seemed to be doing the best in the early stages of the recovery but are now performing much more like other genres.

Adjustments for day-and-date streaming releases. This was taken into account when films were being simultaneously released on HBO Max and in theaters on the same day. Since that’s no longer happening, and we haven’t seen a measurable impact from films being released simultaneously on Peacock, no adjustment is currently being made. We are continuing to monitor this aspect of the industry.

Potential breakout hits. Films from major franchises that have the potential to break out beyond what the model otherwise predicts are identified and their predictions increased in line with the performance of other pandemic-era breakouts. These films are currently selected based on our measurement of audience interest.

The expected recovery of the theatrical market as the pandemic is brought under control. The model assumes that the market will settle back to 70% of its pre-pandemic size at the end of the recovery. Growth will be slow at first, accelerate as more people become confident in going to theaters, and then slow down as more cautious moviegoers take time to return to attending. This is the classic ''S-shaped'' curve seen in economics textbooks (and in many cases in the real world). (For more on this see my previous article, How quickly can the box office recover?) The model assumes that this recovery started on April 1, 2021, plateaued in July due to the wave in COVID in infections caused by the Delta variant, and started again when cases waned at the beginning of October. The rise of the Omicron variant at the beginning of 2022 caused another slowdown, which the model assumes will drag down box office from January–April, 2022. Those parameters are likely to be adjusted as the market situation evolves.

- Current release schedule

Bruce Nash, bruce.nash@the-numbers.com

Methodology

- Recent release schedule changes

- Subscribe to the Bankability Index for full details on our market predictions

-1-News.jpg)